Aliyah: only a five-hour flight but a life-changing journey

When embarking on Aliyah, practical challenges and financial concerns often arise. However, it’s important to recognise the amazing financial benefits that come with making this journey. The decisions you make now will significantly impact your circumstances in the future.

Over the years we have helped thousands of Olim to optimise their savings when making Aliyah, giving us a deep understanding of both the benefits and practical challenges of moving to Israel.

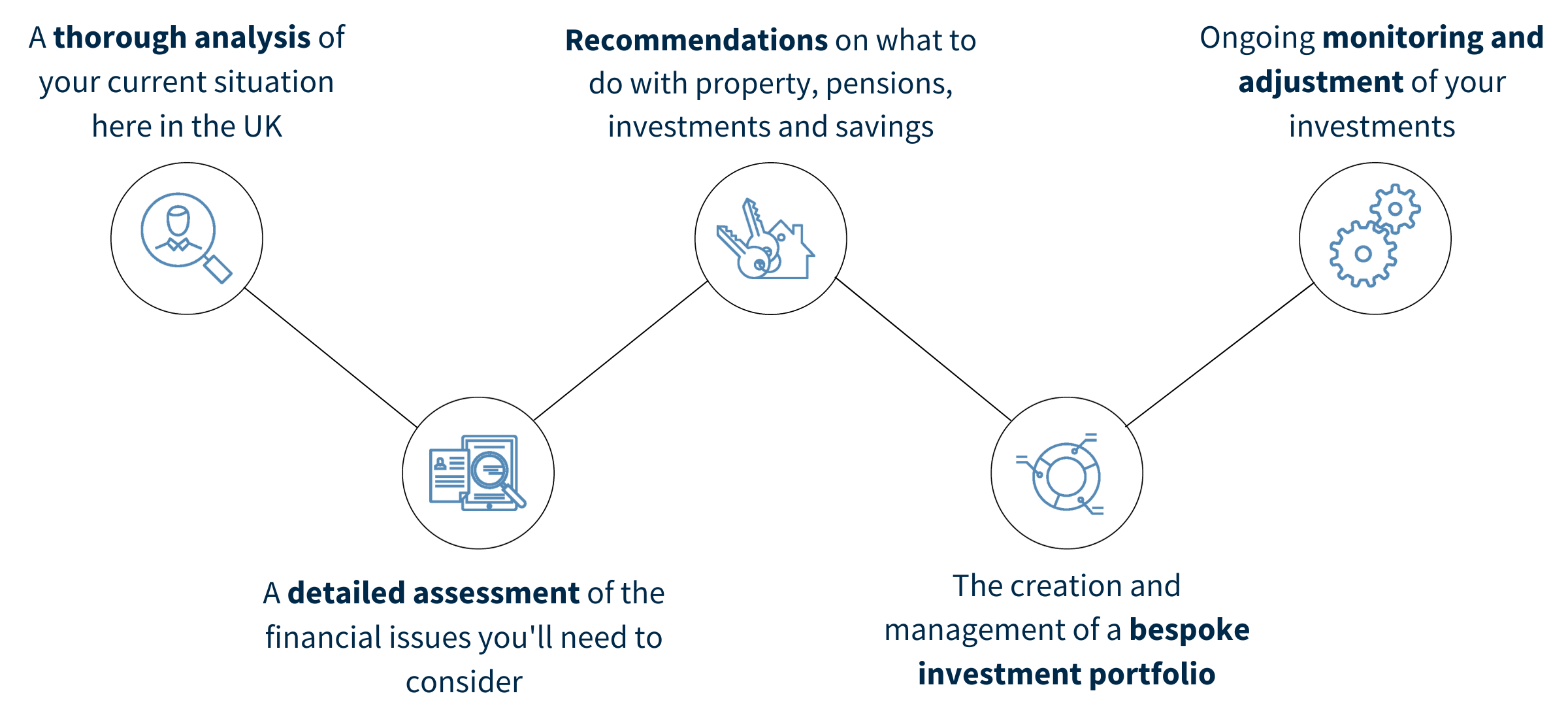

Our aim is to support you in achieving a stable financial future. Count on us to provide you with:

Financial planning for Aliyah

Tax-efficient investing

Our highly qualified team of experienced financial planners will advise on the most appropriate structure for your savings and the most tax efficient way to invest, taking account of your individual circumstances. Leveraging our extensive network of professionals in the UK and Israel, including lawyers and accountants, we can direct Olim to the right people for their needs.

Pension planning for Aliyah

Pensions can be complex, with intricate regulations and frequent rule changes, making it challenging to stay updated. In the most recent tax treaty between the UK and Israel, it became possible for many people to cash in their UK private pension tax-free in Israel. Our financial planning team can guide you through the best options available, including assessing whether cashing in your UK private pension after Aliyah is beneficial and how your state pension should be paid out to you.

Working with your unique circumstances

1. Factfinding stage

- Understanding your current financial and personal circumstances

- Determining your attitude to risk

2. Planning stage

3. Implementation

4. Ongoing support

- Keeping abreast of the ever-changing legislative landscape surrounding investment taxation and financial planning and adjusting your plan accordingly

Bespoke investment management services for Aliyah

When preparing for Aliyah, it’s crucial to have a comprehensive investment strategy in place that considers the challenges of multi-currencies and the impact of new tax rules. Our bespoke investment management services are specifically designed to meet these needs and provide personalised solutions for individuals embarking on this significant journey. Our experienced investment professionals will work closely with you to understand your financial objectives, risk tolerance, and timeline while also navigating the complexities of managing multiple currencies and evolving tax regulations. We will craft a customised investment plan that addresses your requirements such as if you wish to take a regular income from the portfolio. Trust us to deliver tailored investment solutions that align with your goals.

Financial guide for those making Aliyah

Many of our clients set up an offshore portfolio to ensure they maximise their benefit from the unique tax rules of a move to Israel. This solution has some excellent advantages for Olim including no tax within the structure – even after the 10-year tax free period ends, no inheritance tax and high levels of asset protection. We can manage a tailored portfolio within this structure and our frequent visits to Israel help us react and adjust client portfolio to their changing needs and objectives. Our guide optimising your savings discusses this further, alongside other important tips and solutions.

About us

Raymond James, Golders Green has been providing expert wealth management and financial planning services in London for over 20 years.

What our clients say

We aim to offer our clients the very best personal service and portfolio management.

Contact us

Contact us for more information and a no-obligation meeting to discuss your financial needs.